My usual January comment is that I don’t like to make predictions about the financial markets. Psychologically, one tends to get anchored to a prediction they make, and if the markets behave differently, that anchor becomes a pull toward making poor investment decisions.

But I do frequently make note of financial or economic conditions that tend to be present in either strong markets or weak markets, and when we get a growing number of conditions in one direction or the other my antennae begin twitching.

Usually, everyone likes to have a peek into the future, so I want to discuss a couple of indicators that tend to lead economic activity. These are things that often give us clues as to what the economy or the markets might do in coming months.

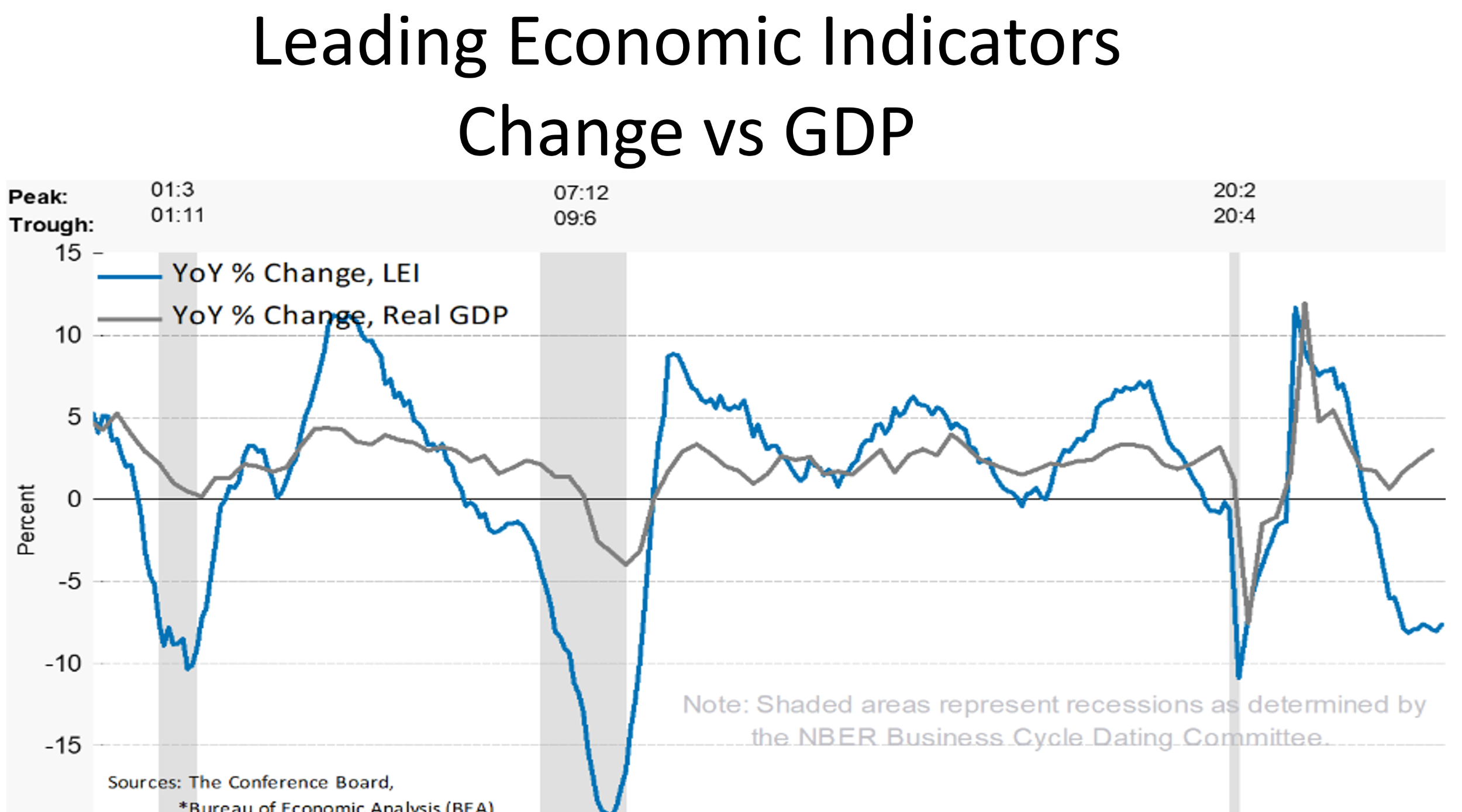

Let’s take a look at the Leading Economic Index (LEI) on this first chart.

This data is from the Conference Board. They are a 100-year-old organization that publishes indices designed to signal peaks and troughs in the business cycles. As you can see from the chart, the Conference Board’s Leading Economic Index® (LEI) tends to turn up and down just before the GDP or Gross Domestic Product, a measure of US economic activity.

The LEI declined 0.5% in November, which is the most recent month reported on at this writing. This follows a 1.0% decline in October.

During the six months ending in November, the LEI contracted by 3.5%. This was on top of a similar decline in the prior six-month period.

So, the Leading Economic Index is clearly trending down, suggesting weakness to come in our economy.

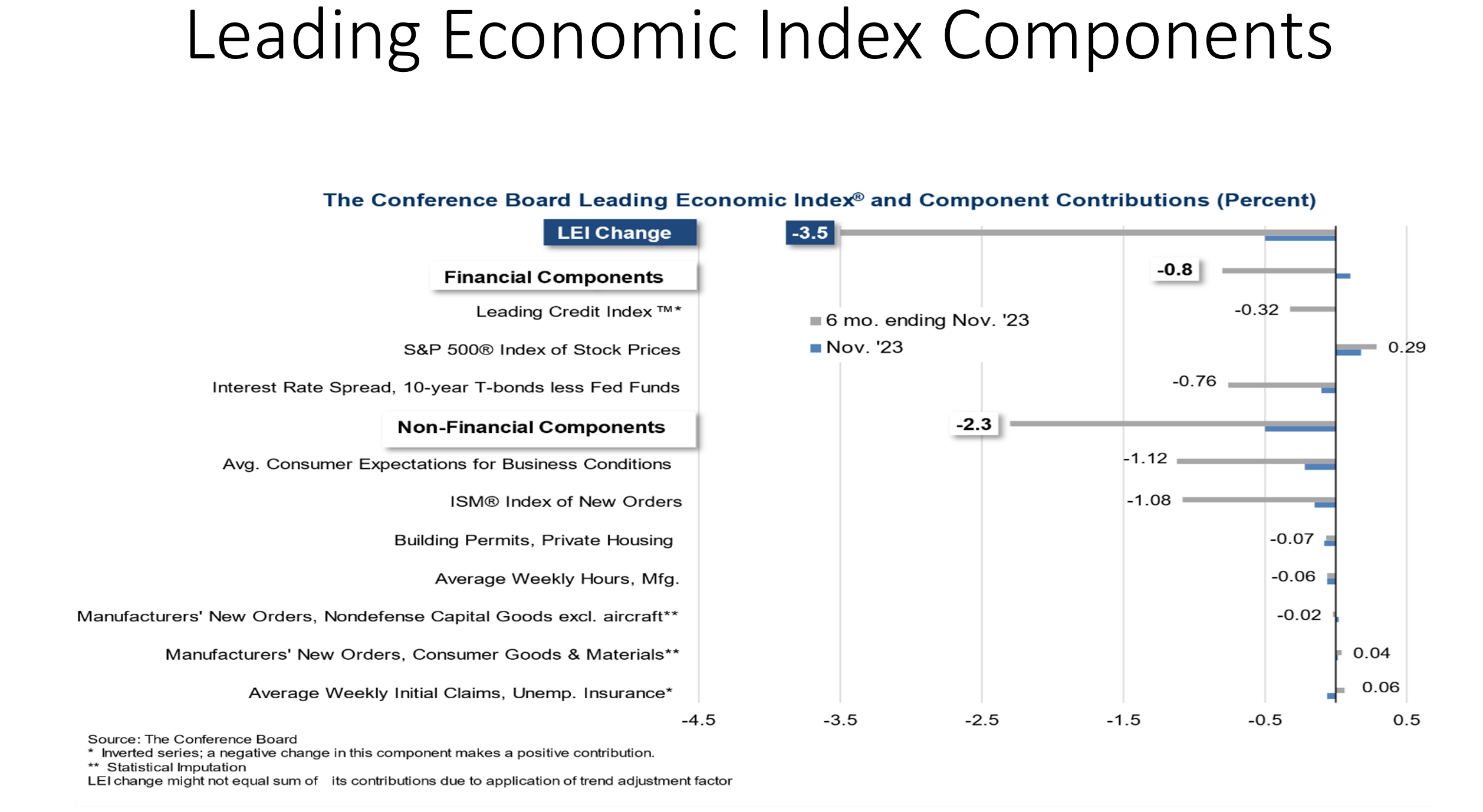

This next chart shows the 10 components that make up the Index of Leading Indicators, listed on the left side of the chart.

Weakness was widespread, with nine of the ten index components either neutral or negative, as you can see by all the activity to the left of the zero line. Stock prices were the only positive component within the index, as you can see by the bars poking out to the right of the zero line.

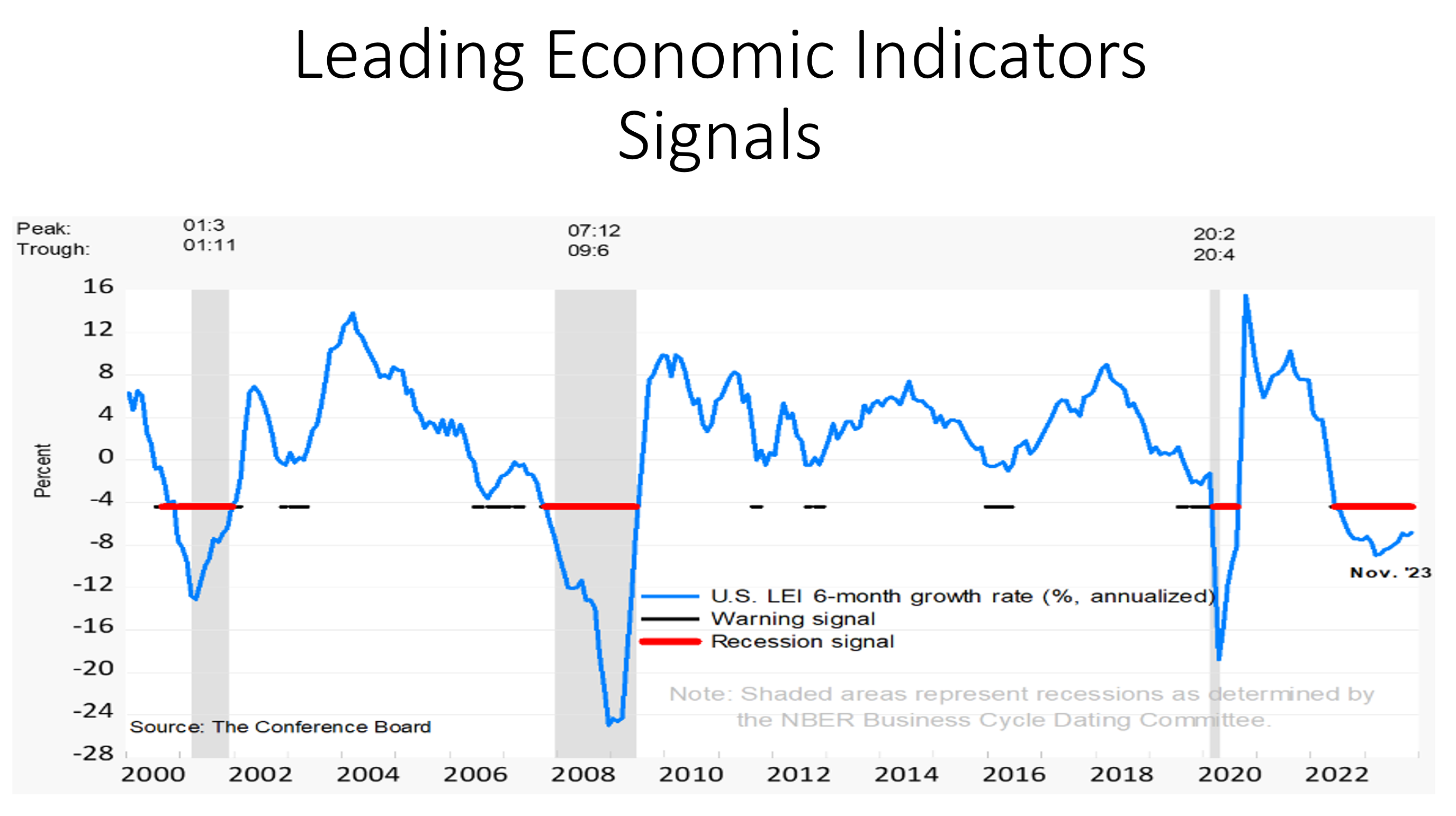

As a result of this decline in the data, the next chart shows recession warnings issued by the Conference Board (the black bars) and actual recessions (the red bars).

As you can see, the Conference Board says that certain segments of our economy have been in recession and forecasts the recession to continue in the first half of 2024. They have suggested it will be a short and shallow recession affecting some industries and leaving others alone, which is why this recession has not been widely recognized.

I should point out that the economy, for which recessions are the bugaboo, and the stock market, which worries about bear markets, are different animals and often act differently.

The Futures Markets can tell us a lot about interest rates going forward and is our next leading indicator.

The futures markets are dominated by institutional investors, often called the “smart money” because they all employ professional traders. These include Hedge funds, pension funds, mutual funds, and brokerage firms.

Rate decreases are important to you and me because these institutional traders employ massive leverage. The less that money costs, the more they can borrow to buy stocks and push the stock market higher – and that is why we watch this data so closely at Shadowridge.

Reducing rates is also a tool the Fed uses to offset weakening economies and get the stock market going. The folks who call the shots on interest rates in the US are called the Federal Open Market Committee (FOMC) and their next meeting is scheduled for January 30th and 31st.

Fed Funds rates are what the Federal Reserve charges banks for overnight loans needed to balance their books. Fed Funds are the interest rate that the Fed has the most control over. All other Treasury rates are determined by market forces.

The current Fed Funds Rate target is 5.25 – 5.5%. You’ll see this reported in the news as 5.5% which means that is the upper limit they want to see.

Actual rates are about 5.33%, well within the range the Fed wants.

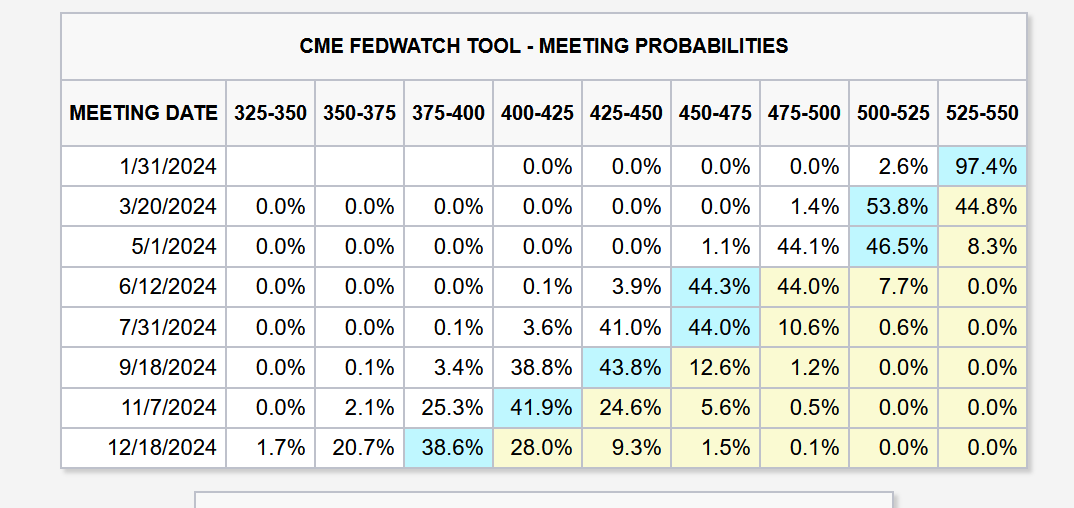

The futures market is now pricing in a greater than 53% probability of a cut in Fed Funds rates at the March 20th FOMC meeting. This chart is how the futures markets show us those probabilities changing over time.

You can see the range of interest rates (without decimals) along the top row, and the meeting dates along the left side. The blue highlights show the rates most futures contracts are at for future meetings. As you can see 97% of futures contracts says Fed Funds Rates will stay unchanged at 5.25-5.50% at the January meeting.

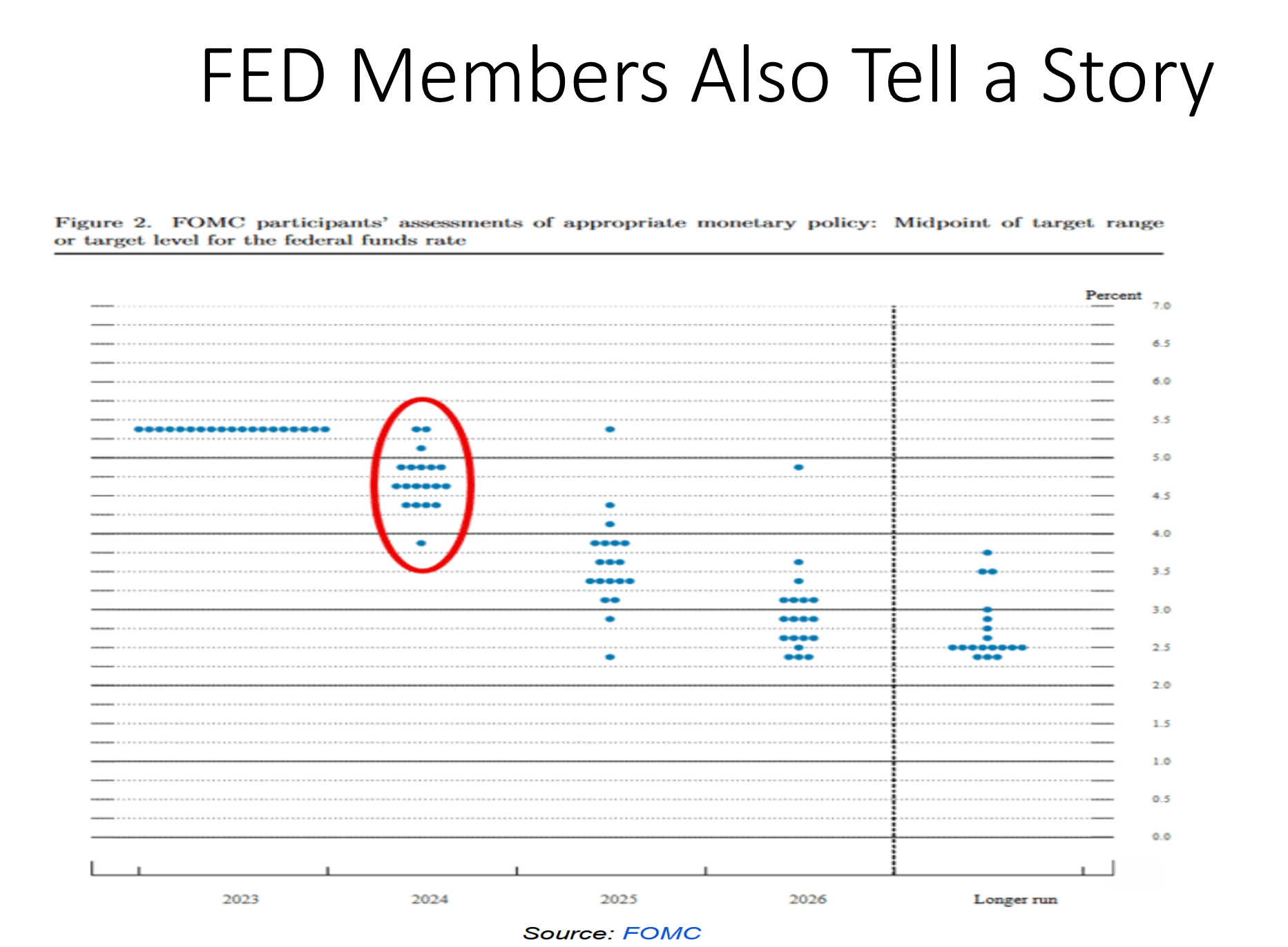

The previous chart showed what the markets were telling us about where they think interest rates are going. The next chart records the opinions of the actual decision makers, the members of the Fed’s Open Market Committee.

The rates are listed down the right side of this chart. Each dot represents the opinion of one committee member. You can see they are mostly clustered near 4.75%, which would imply 3 quarter-point rate cuts sometime during this year.

Hmmm. The futures market is currently predicting 5 or 6 rate cuts and Fed members 3. It will be interesting to see who was right when we get to the end of 2024.

Remember that keeping targeted rates where they are is effectively more economic tightening. That’s because steady interest rates combined with falling inflation means that the difference between the two, which is the real cost of money, is still becoming greater.

Whatever inflation level the Fed wants to see, they’ll need to align target interest rates with inflation quickly. Otherwise, the soft landing they hope for could turn into something harder and more painful.

If you are a current client, you know that at Shadowridge, we are watching this kind of data as part of our proactive approach to investment management. If you are not yet a client and you are interested in a proactive adviser rather than the passive, reactive service that ordinary firms provide, please call our office for a portfolio review. We’d like to help you before the next market correction, not after it’s too late.