Make Money with Postage!

Talk about inflation! The U.S. Postal Service’s proposed new price for first class stamps starting in July is 73 cents. That’s up 8% from the stamp’s current price of 68 cents and 32% more than the 2020 price of 55 cents.

If you want to try a low-risk way to play the commodities market, try Forever Stamps. I bought a boatload of them before the price rose in 2020 and my stash of cheap stamps is paying a great dividend. By July, I will be saving 32% every time I mail a letter.

Speaking of Inflation

In my January 27th newsletter last year, I mentioned that the government was changing the inflation calculation again. They have done this every couple of years for as long as I have been watching these reports. Analysts at the time estimated that this would reduce reported inflation numbers by 2-3% and it sure seems like that is the case. The government says inflation has increased 3.5% over the past year. What do you think?

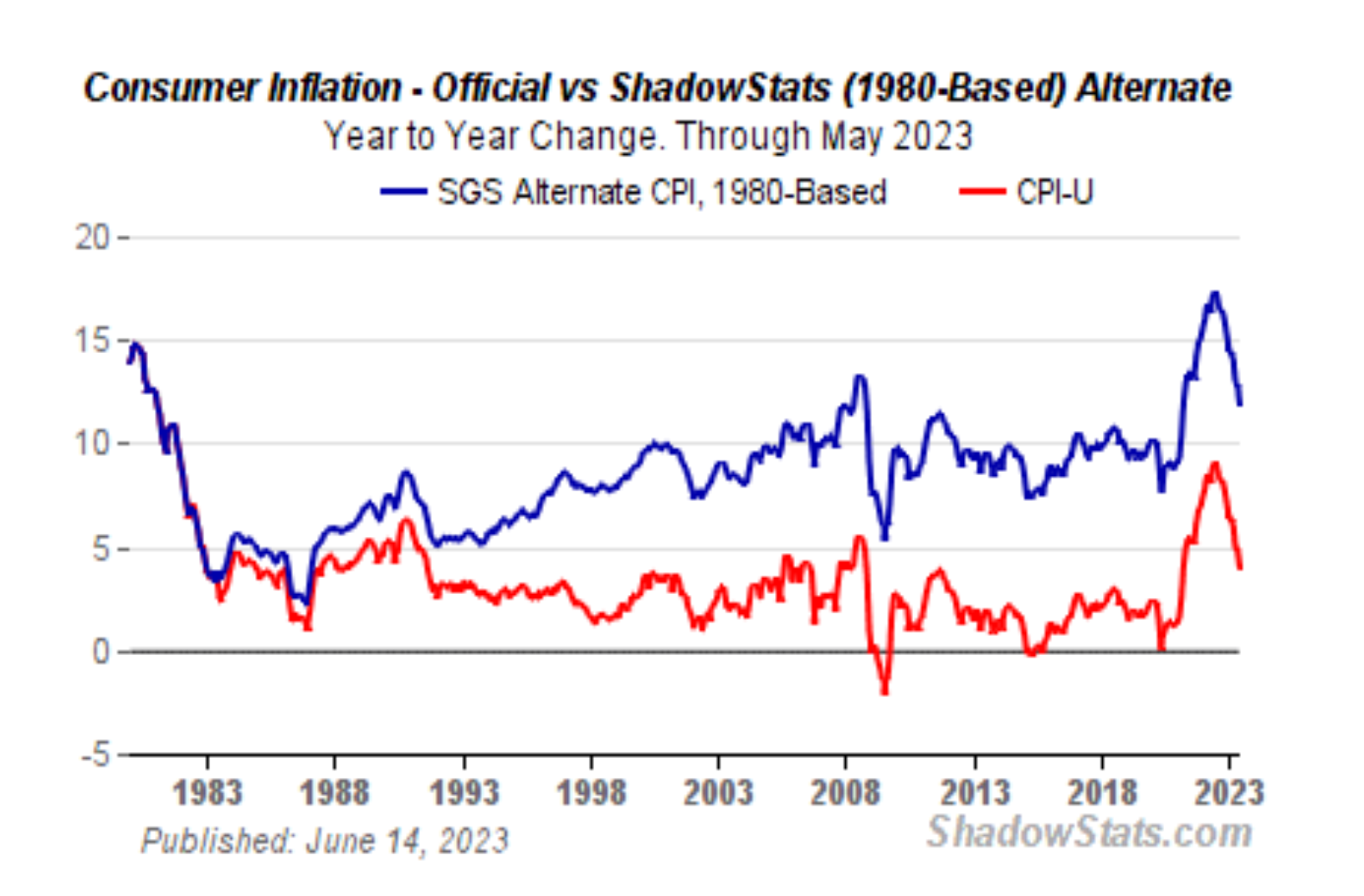

Here is what ShadowStats.com says the inflation rate would be if the government did not make all the adjustments (blue line) compared to the officially reported rate (red line).

According to ShadowStats.com, inflation is running at 12%, down from 17% two years ago, but still just a tad above the government’s 3.5% claim.

Why would stamps rise 8% if inflation was only 3.5%? Hmmm.

Transitory Inflation?

A couple of years ago I mentioned that in the past, once interest rates got above 8%, it took many years to get it to stay below 4% for good. I think that when history is written, it will look at this current dip below 4% as a head fake on the way to another surge in inflation. Stay tuned, because I think inflation will prove to be much more sticky than some politicians want you to believe.

Interest Rate Cuts – NOT!

In our January webinar I noted that the markets were predicting 5-6 interest rate reductions (1 1/2% total) for 2024, while the Fed Governors, the folks who actually make those decisions, were predicting only 3 cuts. I closed my remarks with “It will be interesting to see who is right.”

On April 16th Jerome Powell, the Fed’s chairman, warned that the battle against inflation was taking “longer than expected.” Today the markets are pricing in only 2 interest rate cuts totaling only ½%.

You heard it here first, folks!

Regional Bank Update

It is no secret that many office buildings are empty due to the work-from-home trend, and retail space is empty as we all shop more online. In our February webinar I noted that a perfect storm was brewing for regional banks, due to their holding this commercial real estate tiger by the tail. At that time, regional banks had 43% of their loans secured by commercial real estate and almost half of those loans were coming due in the next few years, per JP Morgan.

On April 19th The New York Times reported that Commercial Real Estate foreclosures were up 6% from the month prior, but a whopping 117% in March from a year ago!

Some areas are getting hit harder than others. California saw 187 commercial properties foreclosed upon last month, the highest of any state. Although foreclosures were up only 8% month to month, they were up 405% from one year ago.

This is a good time to not be holding commercial real estate loans in California, or stock in the regional banks that have the most exposure to this problem.

Last year we saw a couple of spectacular bank failures, including Silicon Valley Bank. Since I don’t believe there is ever just one cockroach, I’d get ready for additional foreclosures and bank failures as more real estate loans come due and can’t be refinanced.