A frequent topic in the financial news recently has been the concept of a Lost Decade. The term first came into use in the 1990s after Japan’s Nikkei Index dropped over fifty percent and took 16 years to regain the 1990 level. (Source: Investopedia)

My term for these periods is Generational Bear Markets, not necessarily because they last that long, but because they wipe out a whole generation of investors, or at least sour them on investing to the point that they can’t stand the thought of anything beyond stashing cash under their mattress.

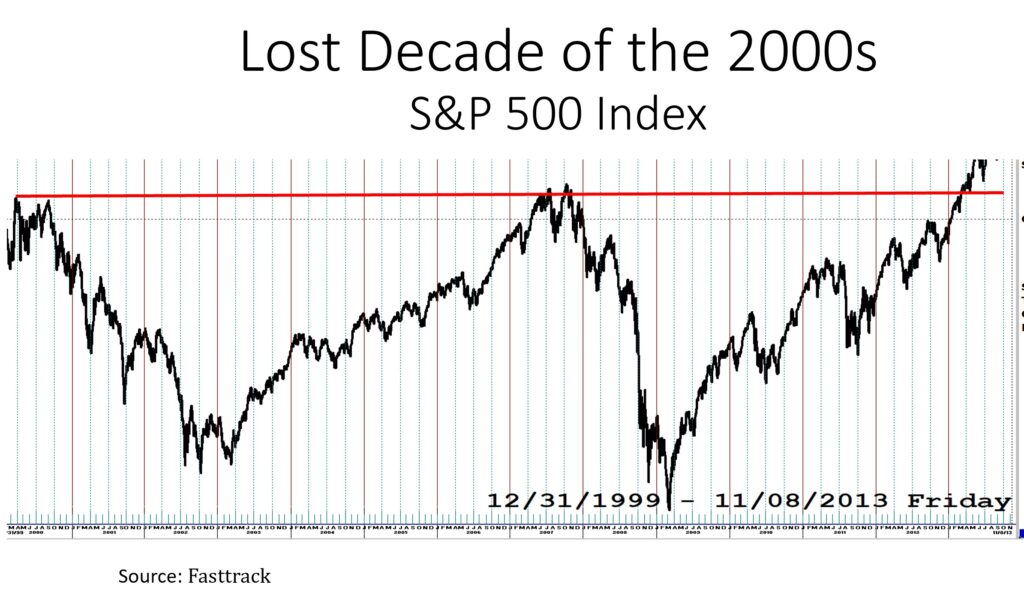

In fact, U.S. investors have seen at least five Generational Bear Markets in recent history. These periods are not just flat for a decade or more. They are extremely volatile, usually presenting several individual bear markets (declines of 20% or greater) within the period. The period from 2000-2013 had two deep bear markets of -52% and -56% losses for index investors. But there were also powerful rallies during this period.

In each of these cases, a buy-and-hold investor looking back from the end of the period would see that the level of the S&P 500 was the same as at the start of the period. All those years with zero returns for the indexes for well over a decade!

And it is worse for investors relying on income from their investments. Those kinds of markets can create a big hole (technical term) for income investors. Drawing 4% income for 13 years means a 52% draw-down on investments. Doing this during a period when the market was essentially flat means principal will be eroded.

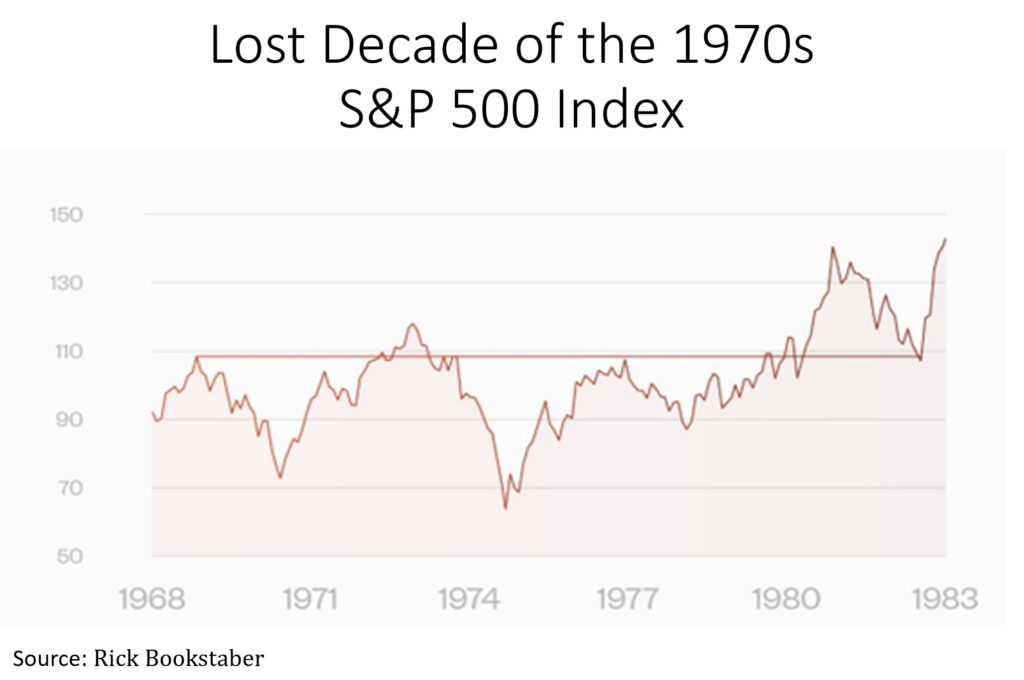

From 1968 to 1983, there was another Generational Bear Market with four sharp declines.

Warren Buffet has a great quote about this time period: “In 1964, the Dow was at 874 and in 1981, it was 875. Now I’m known as a patient guy, but that is not my idea of a worthwhile holding.”

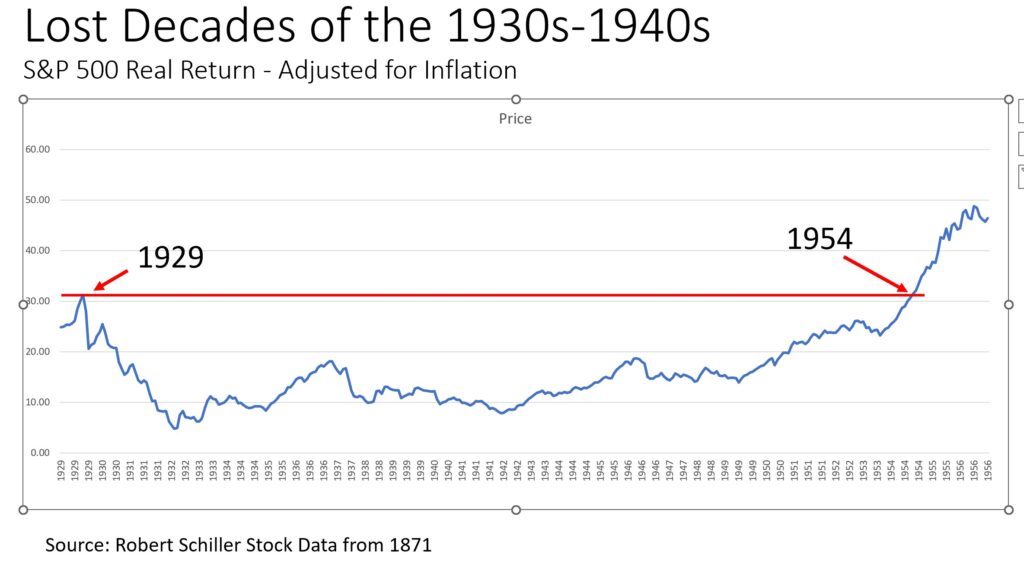

The 1929 to 1954 Generational Bear Market includes the Great Depression, which took investors 25 years to recover.

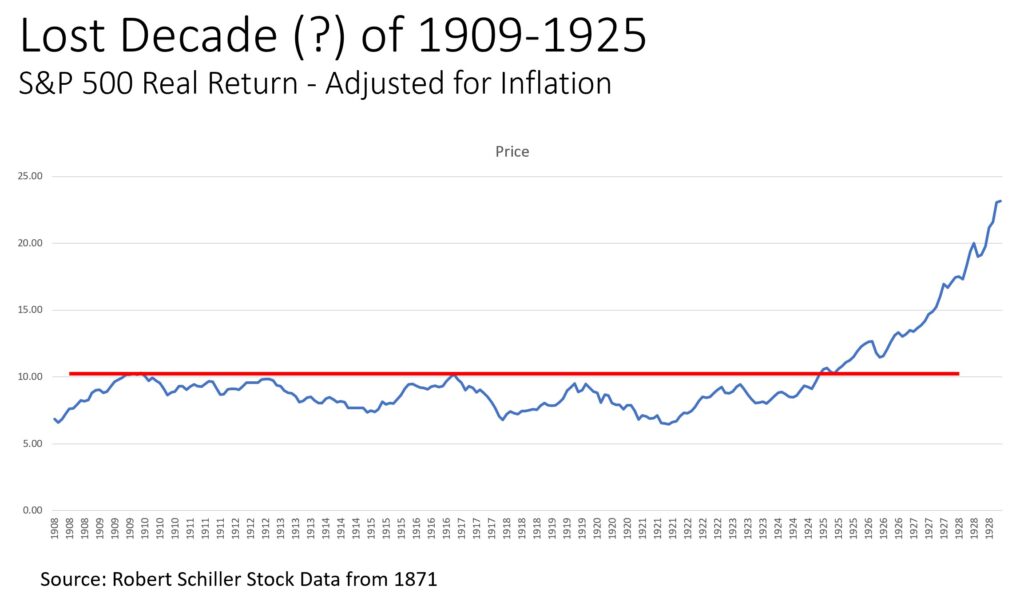

There was another Generational Bear Market from 1909 to 1925, spanning 16 years before index investors broke even.

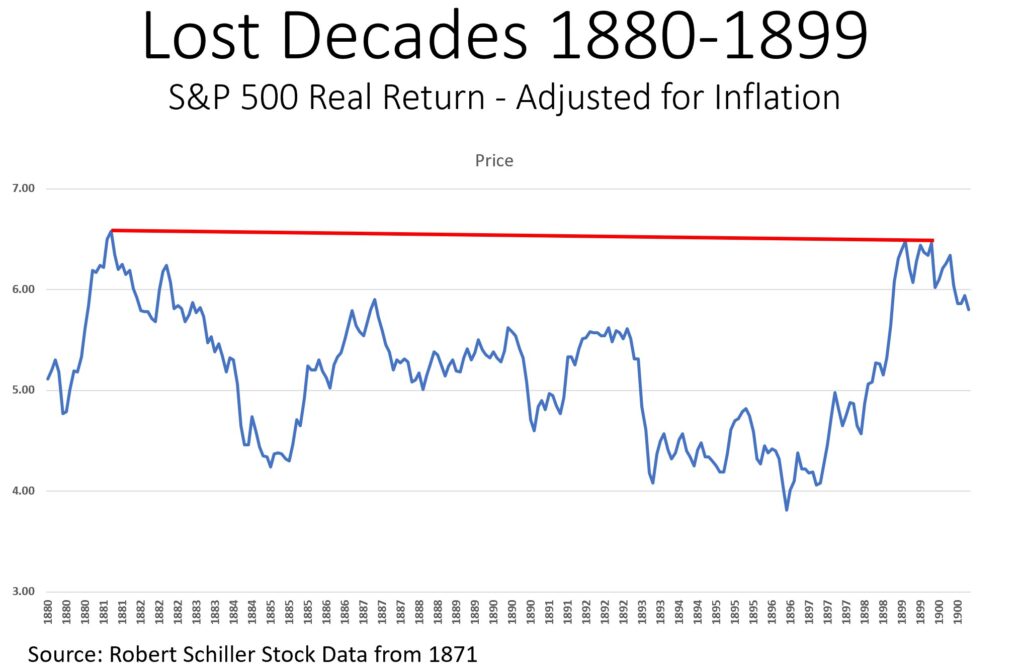

The previous Generational Bear Market lasted from 1880 to 1899 and took 19 years for buy-and-hold investors to break-even.

I could keep going, as these cycles go back for centuries, but you get the picture. Buy and hold investing works great until you get into one of these Generational Bear Markets that are made up of recurring bear markets.

So, as we look at the prospects for this current market decline, we have to wonder if we are setting up to add 2022 to the list as the start of another Generational Bear Market.

This kind of market is usually the result of a sequence of events rather than just one thing going wrong. But clearly, if the market is already weak, there is a greater chance of another event bringing the market down further. And if there are risks coming from many directions, there are even more dominos that might fall.

As for possible dominos right now, there are many of possibilities.

Use of leverage is very high. In October, British pension plans faced insolvency due to using leverage to buy British Treasury bonds with small down payments and borrowing the rest. With their bond market in the tank, lenders saw the value of their collateral drop and they demanded their money back through “margin calls.” But the pension funds didn’t have the cash and were forced to sell bonds into a falling market to repay the lenders. This is what caused the British Prime Minister to get sacked in October. (Source: CNBC)

My “there is never just one cockroach” theory was resonating with that incident. I am watching for other debt defaults to create dominoes as rates rise. A Crypto currency exchange failed a few weeks ago and that may turn into another domino.

Interest rates are rising for the first time in recent memory.

We have the structural risk from inflation. And that might turn into stagflation, with the looming prospect of recession and inflation at the same time.

Many of these risks are all the more troubling because they are outside of our experience. Credit cycles and recessions may be more commonplace, but we have not had much inflation since the 1970s. We haven’t seen rising rates since the early 1980s. Globalization is a new phenomenon and dialing that back has never been done. And the impacts of climate change have no market precedent.

So, what is an investor to do?

Proactive management of your investments can have you invested when markets are strong and moving to cash when markets weaken. This is, in our opinion, the way to beat Generational Bear Markets.

So, if you are not yet a client of Shadowridge, call or email us to set up a free portfolio review to see how proactive management may benefit you.