The stock market had a nice rally recently, but we are still in a bear market, and although I don’t want to throw a wet blanket on the gains from the recent rally, I do want to talk about the potential for a continuation of the bear market and possibly even a stock market crash.

First, let me point out that there is no real definition of a market crash beyond a big hairy drop (technical term there). Stock market crashes are not random. There are specific factors that contribute to the biggest crashes that are not normally present in the economy.

Also, I don’t predict crashes. I merely note when the factors contributing to past crashes are present, which they now are.

The average index returns during the bear markets of 1974, 2001 and 2008 were -58%, meaning an index fund investor during these crashes could have lost 58% of their savings (Source: FastTrack). That doesn’t even count the Big One which lopped 89% off the Dow Jones Industrial Average between 1929 and 1932.

Investors who thought they could just “buy and hold” during these bear markets often had life-altering experiences – the kind that force people back to work or make them move in with their kids.

I am currently thinking a stock market crash is a possibility because some of those factors that were hallmarks of past crashes are present in today’s economy. Weakness in our financial system is my big worry, and there are two primary drivers of this issue.

The first is the unfolding crisis in commercial real estate (CRE). Most banks and insurance companies have huge portfolios of CRE loans, and office and retail buildings are underwater in a big way right now.

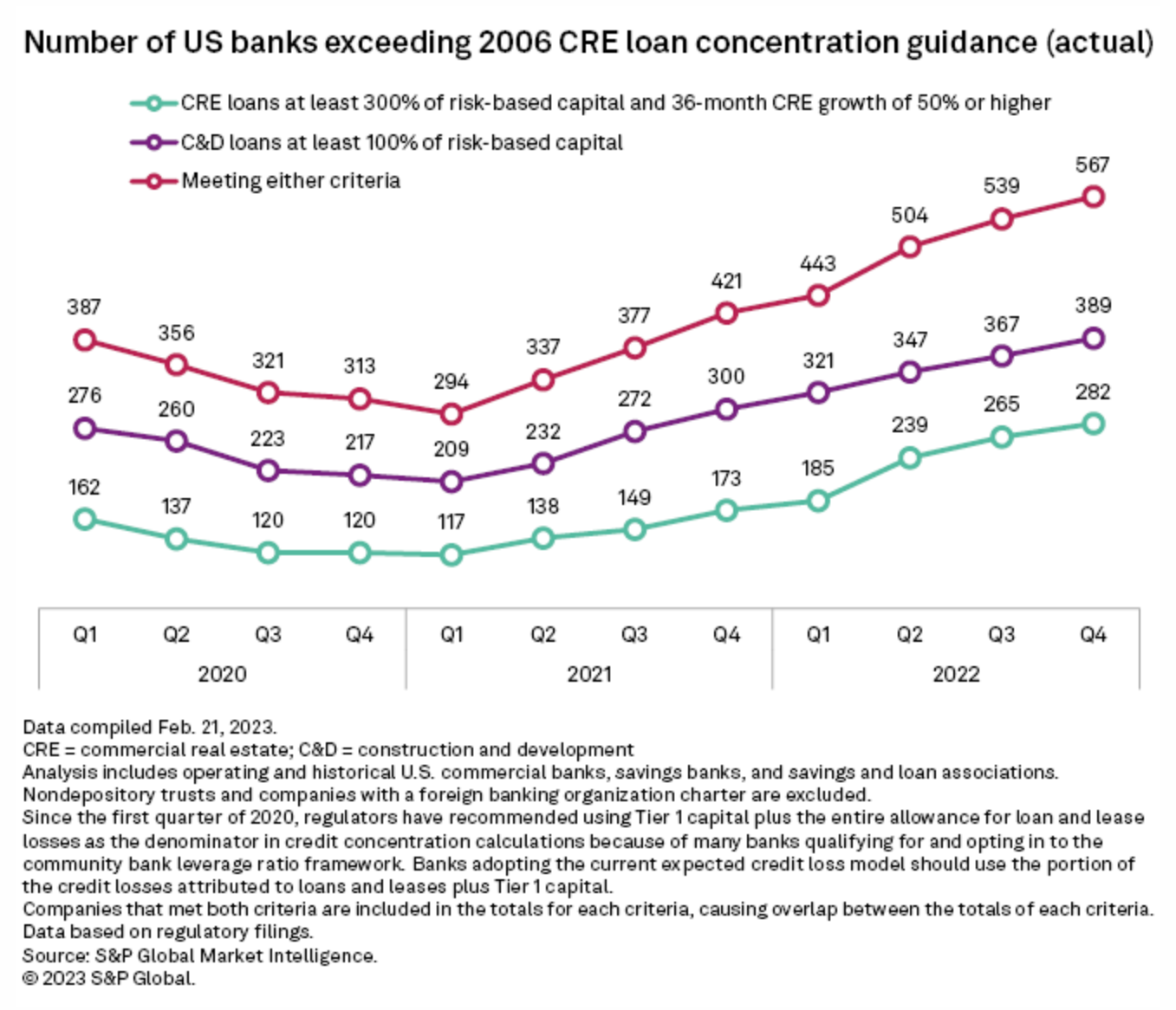

This graph shows the rise in banks with high-risk CRE loans. The green line shows that the number of banks with over 300% of their capital in high-risk CRE loans is rising.

Having 300% of its capital in these risky assets means that if a bank loses just 1/3 of those loans, that bank becomes insolvent and must close. Right now, this chart from S&P Global shows that 282 US banks were in that category at the end of last year. The factors driving this issue (rising interest and high vacancies, for example) have not gotten better. In fact, things have only gotten worse since then, so I’d guess the current number is higher.

The second factor is government spending and debt issuance to support that spending. According to Fox Business, the added deficit for fiscal year 2023 was $1.7 trillion, which needs to be covered by selling IOUs in the form of Treasury bonds.

This is an increase in deficit spending of 23 percent in a single year, about half of which was new bonds issued just to pay interest on old debt.

Albert Einstein said the most powerful force in the universe was compound interest. We now have compound interest working against us.

As a result, investors are demanding higher rates when lending money to the Treasury, which is increasing the cost to repay that debt. This creates a vicious cycle with deficit spending pushing up interest rates, which further increases deficit spending, which pushes up interest rates – and on and on and on.

The biggest bear markets and crashes (1929, 1974, 2001 and 2008, etc.) were all accompanied by financial crises, and we just touched on two humdingers that are brewing right now.

My best guess is that the potential for a serious stock market crash is around 10% currently, which is not a high probability, but is way higher than 0% where it was recently. This is what has my antenna twitching vigorously.

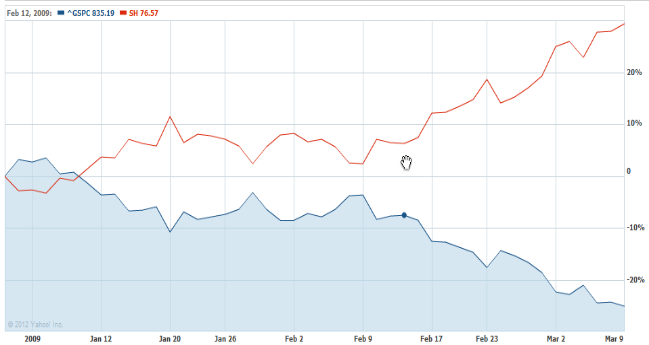

The way to protect oneself from a market crash is to have insurance. The form I prefer is called hedging – using investments that usually go up when a market goes down, such as this inverse S&P 500 hedge (Symbol: SH, shown in red). You can see that it is acting opposite to the S&P 500 Index in the blue shaded area.

Hedges can offset losses in other invested assets, stabilizing a portfolio and allowing an investor to continue to hold their stronger investments without huge risk.

If we were to own 50% of the S&P 500 and 50% of a hedge like the one shown here, the return would be just about zero as one offsets the other. Shooting for a zero return is not a good idea, but if we can hold the strongest investments and hedge the weakest, good things can happen. Let me show you.

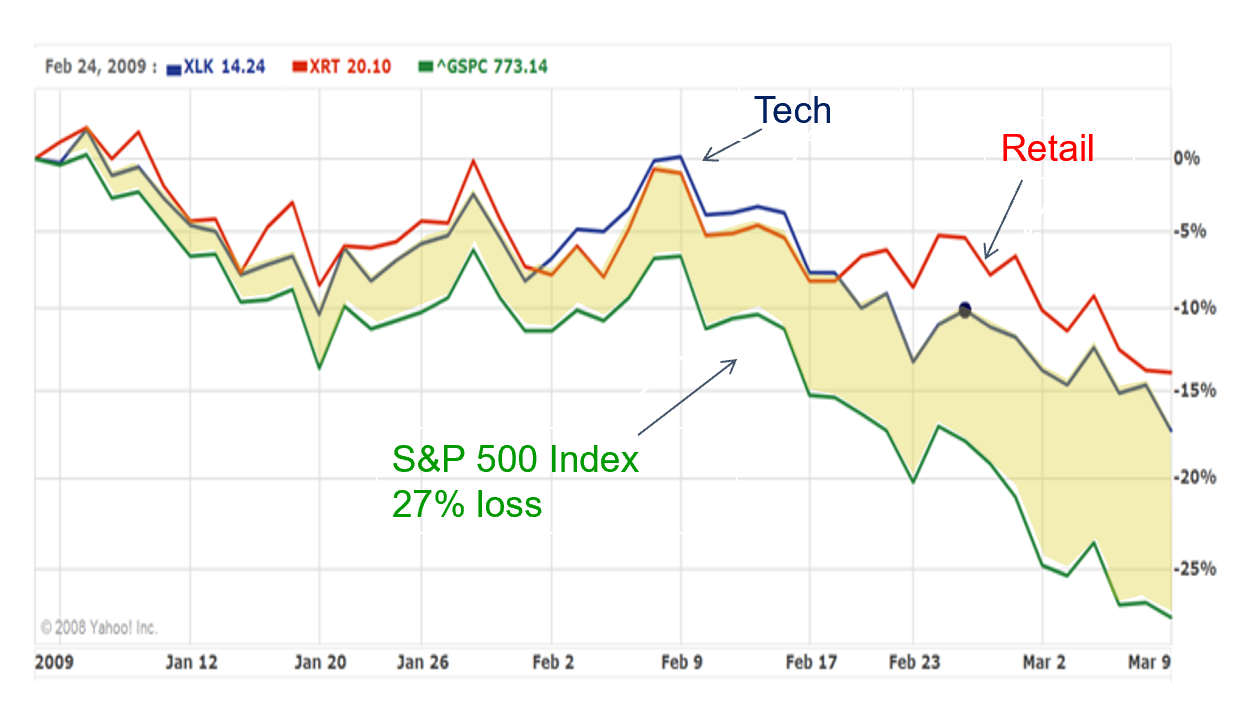

This chart shows the retail index fund (Symbol: XRT, in red) in early 2009 dropping over 14% while the technology index fund (Symbol: XLK in blue) dropped almost 17% in the same time period. However, both of those were stronger than the S&P 500 Index (in green) which dropped 27% in the same period. With some thoughtful hedging, we can capture the shaded area between the stronger and weaker investments as a gain.

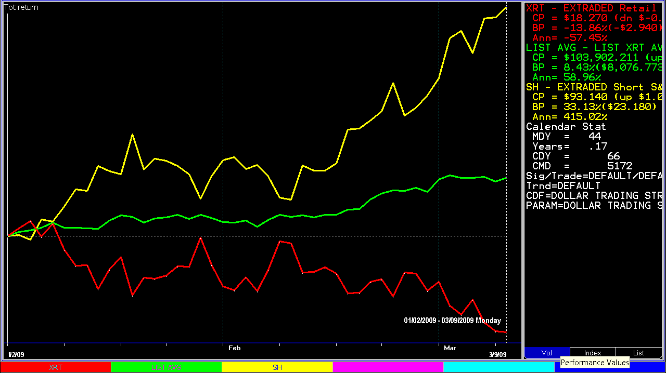

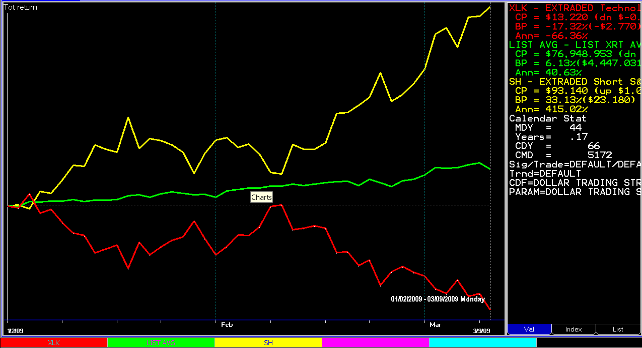

But by combining 50/50 the retail index (in red) and hedging with an inverse S&P 500 fund (in yellow), we would have earned 8.43% (in green). And look how smooth the green line is in comparison. (Source: FastTrack)

On the next chart, we see that by combining the tech index (in red) and hedging with an inverse S&P 500 fund (in yellow) during the same period, we would have earned 6.13% (in green), while the S&P 500 lost 27% of its value.

It is a simple concept, just not easy to execute in real time. Most professionals don’t know how to hedge like this, so kids, don’t try this at home.

Worst case scenario with Shadowridge’s hedged portfolios is that the market turns around and begins to rise and, instead of earning a lot, our hedges lose a bit before we close them out. That is not a bad outcome. Losing more than ½ of your savings and having to get another job is a bad outcome.

They say misery loves company—and that may be true. In every bear market, I hear ordinary advisers’ clients rationalize their losses by saying that everyone else is losing money, too. But I believe that misery is still miserable and something to be avoided. Hedging is one tool we use at Shadowridge to keep our clients out of the misery that bear markets can bring.

If you are not yet a Shadowridge client and you worry about your savings, call us for a free portfolio review: 888.434.1427 – before the crash. Afterward may be too late.