The economy today in China has many similarities to what happened some years back in Japan.

After WWII, Japan’s manufacturing methods were more modern and proving superior to the US in many ways. Japan was so successful that they were buying up iconic properties across the US, including Rockefeller Center in New York, Firestone Tire & Rubber, Columbia Pictures, and Pebble Beach Golf Course. Back in the 1980s, many folks worried that Japan was going to overtake the US economically.

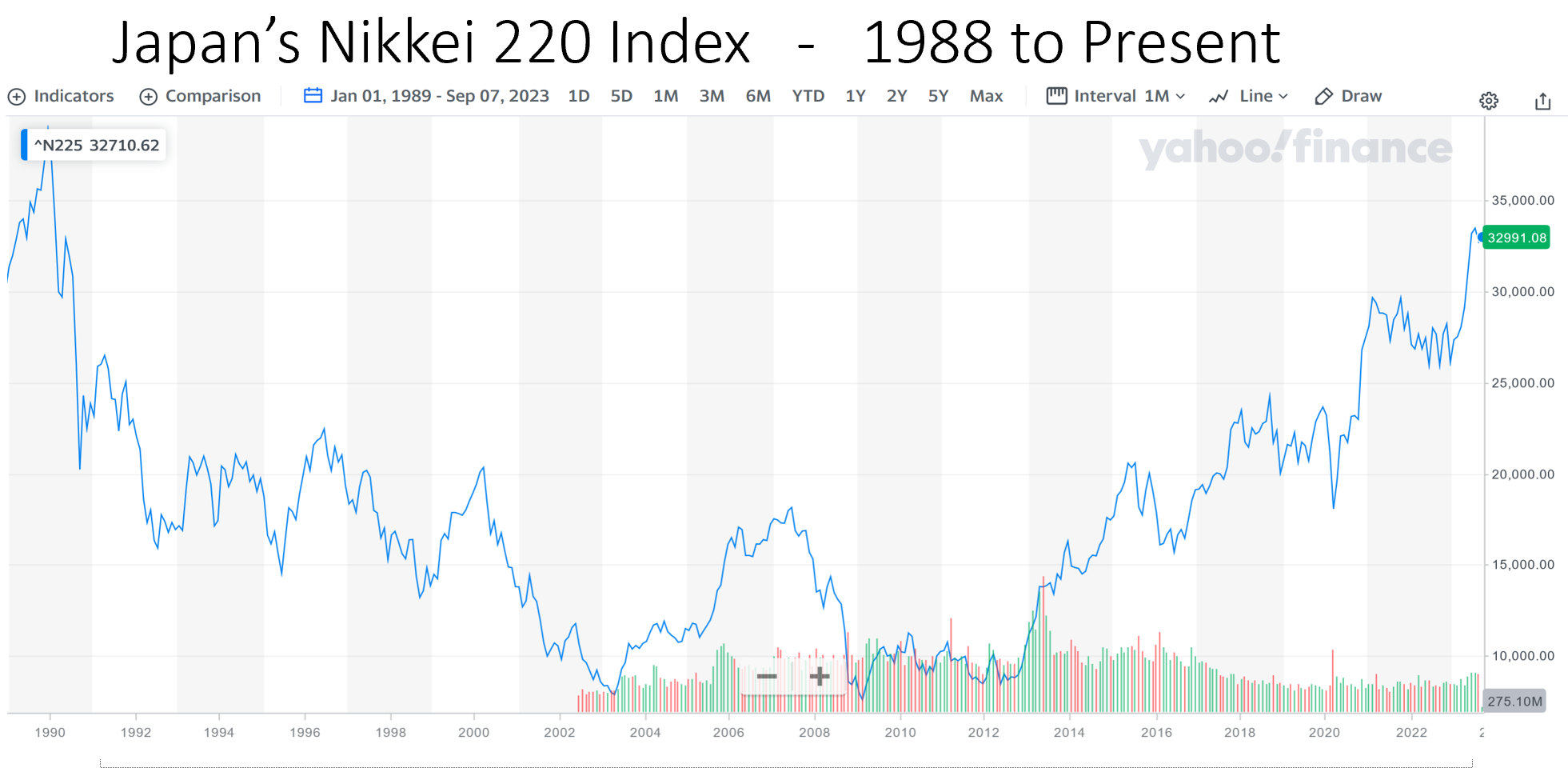

Part of Japan’s success was due to their government deciding which industries would get priority in its centralized economy. In the early 1990s, Japan entered a slump that lasted for more than 20 years and knocked their main stock index down by 80% (see chart below).

This was due to the un-intended consequences of a government-controlled economy.

Anyone who follows economics knows that inflation is caused by too many dollars chasing too few goods, pushing the price of goods up as people try to acquire them with the many dollars they have. Deflation is the opposite: too many goods chasing too few dollars. Deflation is worse in many ways than inflation. Inflation may destroy savings, but deflation destroys businesses as sales dry up, and is much harder to reverse than inflation. Japan’s problem in the 1990s and 2000s was deflation in their economy.

For the past 10-20 years, China’s booming economy has been driven by investments in factories, skyscrapers and infrastructure projects. A booming housing market has accounted for more than 25% of China’s economy in some years. This all sparked an extraordinary period of growth that lifted China out of poverty and made it an economic giant.

There are many similarities in the government-controlled economies of 1980s Japan and China today, and for many years I have wondered when the wheels would come off of the economy in China, because I believe that no one, not even a dictatorial government, is stronger than the free market. I believe it is finally happening to China and in a big way, and deflation is again part of the scenario.

According to the World Bank, over the past 50 years, China increased per capita income 25-fold and lifted more than 800 million Chinese people out of poverty. China evolved from a nation racked by famine into the world’s second-largest economy, and America’s greatest competitor for leadership.

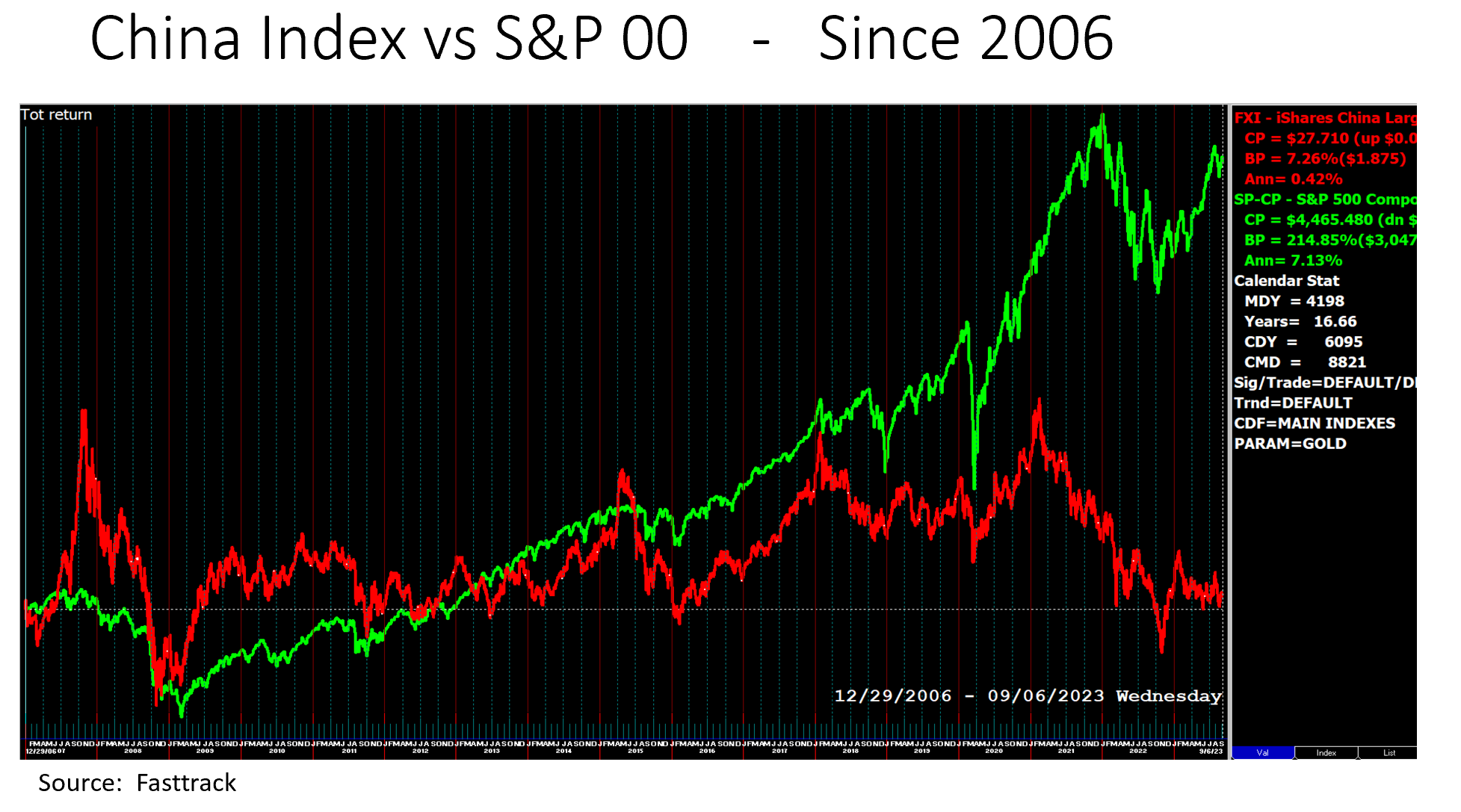

However, China’s economy is still considered an “emerging market” by investors because China does not have transparent, standardized accounting and the rule of law governing them. In fact, as you can see in the 17-year chart below, investors have shunned China’s stock markets despite the much-ballyhooed growth of the past few decades.

China’s Hang Seng Stock Market Index, the red line on this chart, has chopped violently up and down over the past 20 years or so but has really just gone sideways as you can see by the levels of the 4 major stock market tops. It has not risen, but struggled to reach previous levels before falling back again.

In its most recent bear market, China’s Hang Seng stock index, again in red, has lost 48% of its value in 2½ years and their recovery from the draconian Covid-19 lockdowns has been tepid at best.

China is drowning in debt and running out of things to build. Parts of China are saddled with under-used bridges and airports. Millions of apartments are unoccupied. China’s Youth Unemployment rate is so bad that their government stopped reporting its level a few months ago. The last report from BBC News shows that China’s Youth Unemployment rate was 20% in June 2023. Having no jobs waiting as a record 11 million university graduates are expected to enter the Chinese job market this year is a big deal.

China’s biggest #1 problem is providing food and paychecks for hundreds of millions. Even a dictatorship can’t handle an uprising of millions, so full employment has been a way to keep people from getting too restless.

One huge unintended consequence of the “one child per family” law in effect for almost 40 years until recently, which was designed to help the country avoid famines, is the fact that China now has an aging labor force with fewer young workers compared to the retirement age workers.

Productivity in an economy is measured by multiplying the number of workers times what they produce. In China, this dynamic of fewer people working reduces the overall productivity of the Chinese economy and threatens the increased standard of living that its people have gotten used to.

I’ve observed that the outlook has darkened considerably in recent months. According to Bloomberg, manufacturing activity has contracted, and exports have declined by 14%. BBC News reports China’s CPI inflation measure came in flat in June. Producer prices which lead the economy have gone into a tailspin, so deflation might be a bigger problem than previously imagined.

One of the China’s largest surviving property developers, Country Garden Holdings, is on the cusp of a possible default as the overall economy slips into deflation. Country Garden warned of up to $7.6bn loss in July 2023.

Evergrande, which was once China’s biggest real estate firm, revealed that in 2021 and 2022 it lost a combined $81.1bn. According to BBC News Evergrande is carrying $300 billion in debt. That is more than many countries, such as Portugal, Philippines, and Malaysia! And that is the debt of just one Chinese company! Debt is hard to pay off during times of deflation because there is less cash circulating, and borrowers need to raise cash to service their debt, but can’t.

Evergrande’s share price is down 99% from 3 years ago, which tells me that Evergrande is circling the drain.

Meanwhile, government crackdowns in recent years have left the private sector in China reeling. Beijing has led targeted campaigns against industries like technology, media, education and even food delivery, sapping the confidence of the business community. The restrictions on economic activity have prompted many Chinese citizens and companies, alike, to save their cash, rather than spend or invest it, adding to the “too little money chasing too many goods” deflation scenario.

So, my advice about investing in China is, “Children, don’t try this at home.” Be very, very careful if you are investing in China, as they are in for a rocky ride.

If you find this article interesting, please forward this newsletter to your friends. They will thank you.