The Fed’s Bureau of Labor Statistics (BLS) recently announced changes to the way the Consumer Price Index (CPI) measures inflation. The Fed’s February 12th announcement will include these newest changes.

The government constantly fiddles with the CPI calculations, normally to make themselves look good, or at least not as bad. Some years ago, in researching for my college class, I came across an article that said the CPI calculation had changed 22 times in 30 years since 1980 and each time the reported inflation numbers were lower than they would have been without the change.

As you and I go about our lives, we can see that gasoline prices are almost double what they were two years ago. Food prices are way up. Rents and home prices, too. But the reported CPI is up only single digits. What is wrong with this picture?

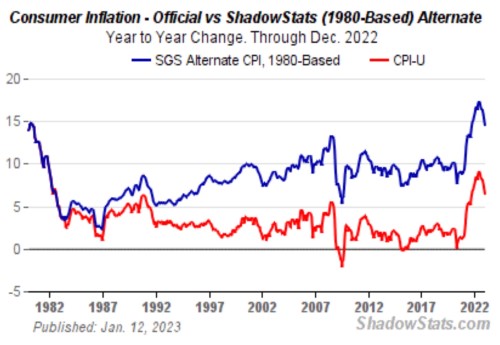

If a picture is worth 1,000 words, a chart is worth 1,000 numbers. In the chart, below, ShadowStats.com shows the Currently reported CPI numbers (red line), alongside the CPI if the 1980 formula were still used (blue line).

If you are like me, the blue line showing inflation peaking at 17% a few months ago, more accurately reflects our reality better than the government’s current reporting in the red line.

Starting in February, the CPI calculation will change the base reporting number used in year-over-year inflation reporting. I won’t bore you with the math behind it, but according to Luke Gromen who publishes Forest For The Trees Newsletter this change “seems likely to step up year-ago inflation comparisons, beginning almost immediately, leading to the likelihood of a series of sharp drops in reported CPI in coming months, even if nothing else changes.“ The article mentions that due to these changes, by June of this year, the CPI could end up being 2-3% lower than currently reported. That is a big adjustment! There must be an election coming up.

Wise investors should note that lower currently reported inflation will not wipe out the price increases of the past two years. Prices will remain painfully high even though the CPI is moderating and history suggests that the winds of inflation will continue to blow for quite a few years.

I can’t wait to see what ShadowStats reports a few years from now about real-life inflation vs the government calculations.