July may end up being the best month of 2022 so far, if it can hold up the gains it made this week, post-Federal Reserve Rate hike. However, the major US indexes still have a ways to go just to get back to where they started at the beginning of this year. And making up for the extra-ugly 2nd quarter will take some time and positive news.

The big news this week is that the Federal Reserve did again raise rates by 0.75%. This is largely what was expected. There had been talk of as high as a 1.00% increase, but in the post-announcement press conference, it was said that the vote was unanimous for 0.75%. In addition, the Fed said that they believe that the employment situation is still strong enough to not require more of an increase at this time.

Another big news item is that we got the numbers to confirm the second quarter of negative GDP. Since I can remember this has been used as the gauge to declare a recession, though I understand that the current stance is that “recession” is not yet “official.” There has been quite a bit of effort to dismiss this GDP data point due to the continued low unemployment. And at the end of the day, it doesn’t matter if we are or we aren’t in a recession, but how we react.

Usually, we don’t know we were in a recession until after it is over, so maybe now that we know of the two negative quarters, things might be on the upswing. In short, it’s just not clear yet.

The 2 and 10 year interest rate yields did also (again) invert this month. That is also often a precursor to a recession in the coming year. This is the 3rd inversion we’ve had now in the past 3 years. We think unemployment is the key to when we might actually see recession become apparent… who knows? Our job is not to predict. It is to observe and to plan.

Whether we are or will be in a recession isn’t as important as having a plan on how to survive and even thrive in that environment. Even now, the economic environment out there is ugly and inflation is making it difficult for many people to buy basic needs. Even Walmart reported in its earnings this week that their customers appeared to be cutting back on their spending. To us, this means more underlying issues need to be resolved before we can truly feel we are out of the woods on this issue. Our plan is to keep vigilant on how this data is changing and staying on top of the market’s major trends.

Our Shadowridge Long-Term Trend and Mid-Term Cycle signal signals are both positive again. Though, they aren’t showing a lot of strength. The biggest change we made was to remove our hedges (short/inverse funds) to allow what we did still own to run as the market is moving up. However, we’re coming into the historically worst 3 months of the year so we’ll be quick to add back protection if those signals tell us to do so.

As of Wednesday night (July 28th, 2022), our Shadowridge Dashboard showed Positive to Negative sectors as 11 to 0. But that may be largely due to the strong positive movement after this week’s Fed announcement. The past few times when the market went up on a Fed day, there was a negative reversal on the following days. So we’re keeping that in mind.

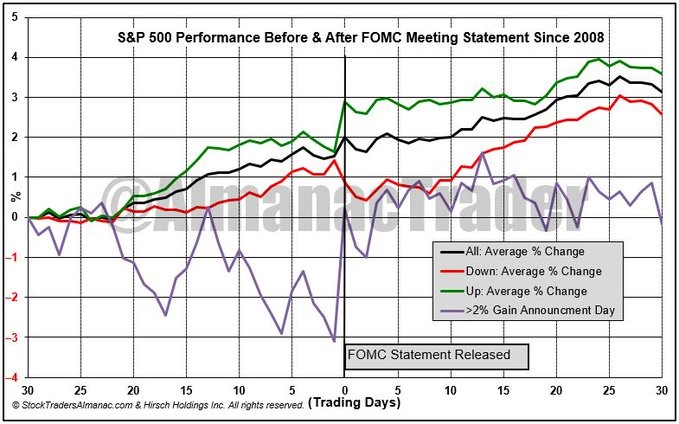

For this month’s chart, I want to look at how the S&P 500 acts around FOMC Statements (like we had this week). The chart is from Jeff Hirsch’s Twitter (@almanactrader) feed and what is most interesting to me is how the S&P 500 acts after a >2% Up Day on the Fed Announcement Day (Wednesday this week). Even though that one day move can be strong, it looks possible that we’ll see a more sideways and choppy movement going forward. However, if we don’t follow that pattern, there is also the possibility of a slower drift upward (Green line).

Bonds – as of this writing, the Aggregate Bond Index AGG is down -8.54% YTD in 2022. The 7-10 year Treasury bond index is -8.84% this year (FastTrack Data). There has also been some improvement in the Bond market this past month, though we’re still very cautious about diving back in too heavily. Keep in mind that as interest rates rise, bond prices fall.

As we said last month, this can mean some pretty unnerving times for those in a traditional 60/40 (stock/bond ratio) portfolio. In the current environment, preservation-minded investors like those who have recently retired need something that works differently. If ever there was an environment that favored pro-active management, that would be now. Our main focus in this environment is on protecting principal. We don’t want you to experience a life-altering financial crisis when you retire, so we pride ourselves on being diligent in watching our clients’ investments.

Stay safe out there!!

Don’t forget to catch our monthly webinar, where I dive deeper into what I have mentioned in this newsletter commentary. For me, nothing tells the story as much as visuals, so I really enjoy the webinar for digging into what we’re doing with investment decisions. Will, Phil, and Laura will also be presenting timely topics to help you face life’s financial challenges and opportunities. We hope you can join us – Thursday, August 11th at noon Central time.

You can sign up for the webinar here. We look forward to seeing you there!

Continue reading for Financial Planning articles from our team!

1 The Standard and Poor’s 500 is an unmanaged, capitalization-weighted benchmark that tracks broad-based changes in the U.S. stock market. This index of 500 common stocks is comprised of 400 industrial, 20 transportation, 40 utility, and 40 financial companies representing major U.S. industry sectors. The index is calculated on a total return basis with dividends reinvested and is not available for direct investment.

2 Charts are for informational purposes only and are not intended to be a projection or prediction of current or future performance of any specific product. All financial products have an element of risk and may experience loss. Past performance is not indicative of future results.